Financing Growth: Funding Options for Cannabis and Hemp Businesses

Introduction As the cannabis and hemp industries continue to grow, securing adequate funding remains a pivotal challenge for many businesses. This article explores various funding options available to entrepreneurs in these sectors, highlighting the unique challenges and opportunities they present.

Traditional Banking Challenges Due to federal regulations in some regions, particularly the United States, traditional banking services and loans remain largely inaccessible to cannabis-related businesses. This section would detail alternative financing strategies that have emerged as a result.

Venture Capital and Private Equity Venture capital and private equity have become significant sources of funding for cannabis businesses capable of demonstrating high growth potential. This segment explains how to attract venture capital by aligning your business model with investor interests and preparing a compelling pitch.

Angel Investors Angel investors are private individuals who provide capital for startups, often in exchange for convertible debt or ownership equity. Networking in industry events and cannabis business conferences can be effective ways to meet potential investors looking for new opportunities in the cannabis sector.

Crowdfunding Crowdfunding platforms offer another avenue for cannabis startups to raise funds. While regulatory scrutiny is high, successful crowdfunding campaigns can provide not only necessary capital but also a strong base of initial customers and brand advocates.

Public Markets For more established companies, going public may be a viable option. This part would outline the process of launching an initial public offering (IPO) or trading on public stock exchanges that accept cannabis-related businesses, along with the associated challenges and benefits.

Debt Financing Though more difficult to secure in the cannabis industry, debt financing options like loans and credit lines are gradually becoming more available as the legal landscape changes. The section would include advice on preparing business documentation and financial projections to improve the chances of securing debt financing.

Grants and Government Programs In some regions, government grants or programs are available to support agricultural and business development, including cannabis and hemp. Identifying and applying for these can provide a significant financial boost without the need to give up equity or pay interest.

Strategic Partnerships Forming strategic partnerships with other companies in the cannabis supply chain can also facilitate financial growth. Partnerships can provide in-kind support, investment, or resources that reduce costs and increase operational efficiency.

Conclusion Navigating the complex financial landscape of the cannabis and hemp industries requires creativity and perseverance. By understanding the full spectrum of financing options available, businesses can better position themselves for successful growth and expansion.

Further Exploration For those looking to delve deeper into cannabis and hemp business financing, our series continues with real-world case studies, interviews with industry financiers, and detailed guides on navigating the investment process. These resources offer valuable insights and practical tips for securing the funding needed to thrive in these dynamic markets.

BOOST YOUR YIELDS

Soil Savants

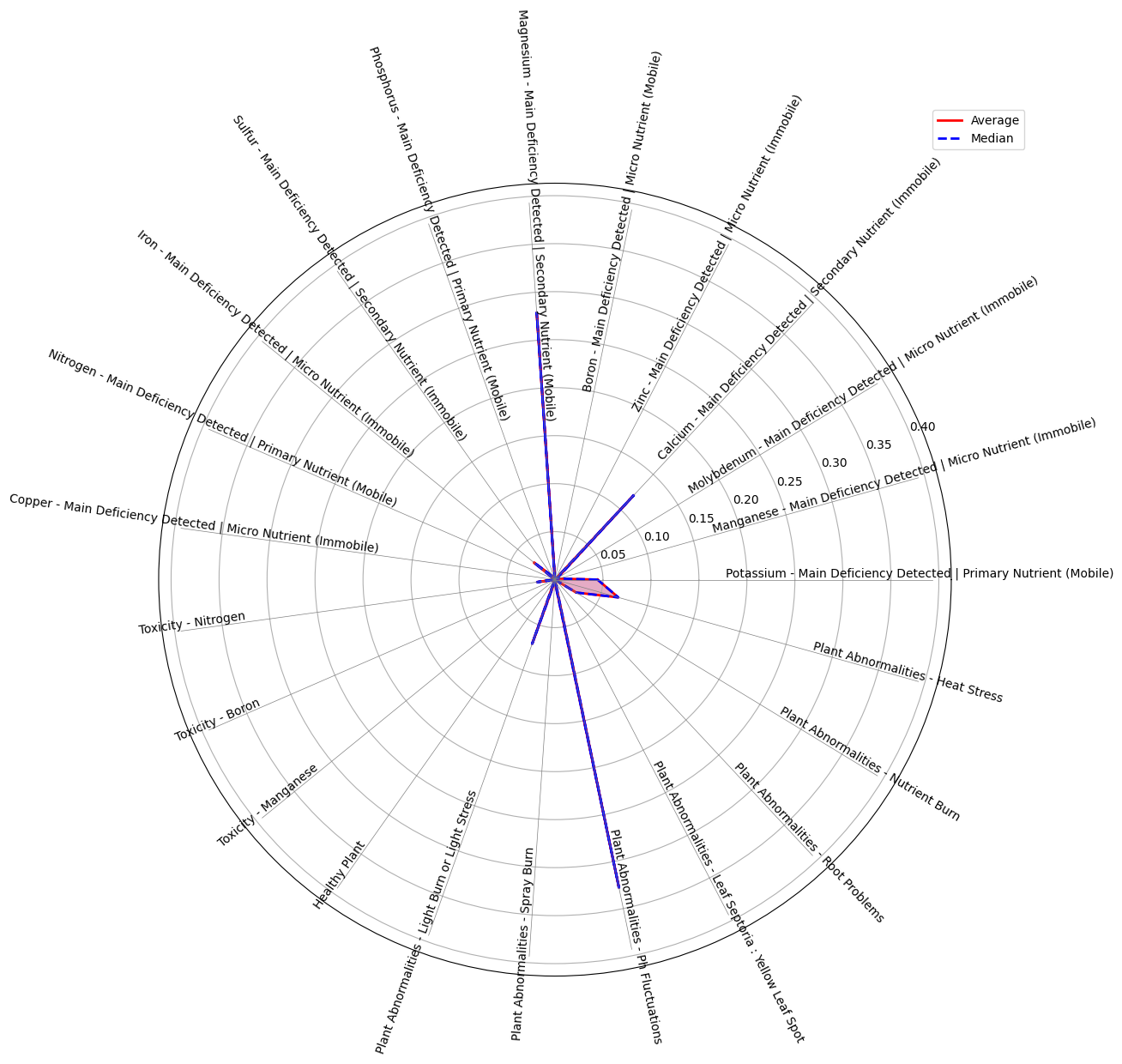

Analysis (Leaf) - Genus: HEMP / Cannabis S. | Segment Issues Early

Share